An overview of the asset class and special features when selecting managers

In times of historically low interest rates, there has been an increasing trend among institutional investors towards alternative asset classes, both in the liquid and in the illiquid investment markets. These markets, however, have higher demands on the selection of the right investment strategies and managers. They are more complex, are divided into sometimes very different niches and require careful handling of illiquidity.

In this article we provide an overview of the Liquid Alternative Credit asset class and describe the particularities of manager due diligence in this asset class.

Liquid Alternative Credit

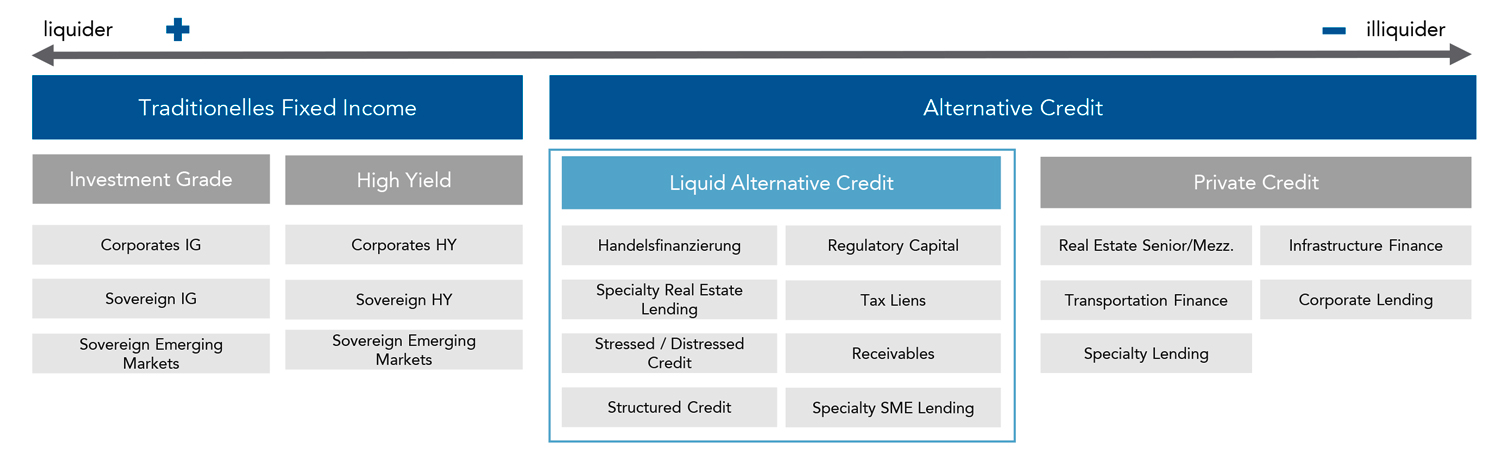

The asset class Liquid Alternative Credit comprises credit-based strategies with liquidity between traditional fixed income and private credit.

Many of these strategies address specific niche areas that have developed on the open market since 2008 due to increasing regulatory constraints on banks. The strategies are usually investable through open-ended funds that offer quarterly liquidity and are often managed by former bank employees. In addition to the relatively short maturities of transactions, liquidity in some strategies is supported by a well-established secondary market.

Liquid Alternative Credit Features

Most strategies in this asset class are limited in capacity and managers often focus on a specific segment. By focussing on such niche strategies, earnings of between 7% and 12% p.a. are currently generated.

Liquid alternative credit strategies usually offer a high degree of security at several levels. The strategies have a low correlation to traditional fixed income and very low volatility. The individual managers have a high operational effort as they sometimes manage several hundred different positions in their portfolio. Identifying the investments is also very time-consuming, so that often only small amounts can be invested or lent.

Particularities of Manager Selection

As is usual in liquid investment strategies, we divide the manager selection into a qualitative and a quantitative part. We consider both parts to be equally important. The final evaluation and selection of the managers then is made in line with the “best-in-class” requirements of the strategy, but also on the basis of the specifications and restrictions of the target portfolio.

Trade finance in particular

In the Liquid Alternative Credit area, the individual strategies and the special features of manager selection are too different to describe them in general across the asset class. Therefore we will take a closer look at a trade financing example.

Qualitative manager selection

1. Investment Team

Managers should have a strong risk aversion or rather no-loss mentality, and similar to the back office in a bank, the risk manager should be directly involved in the structuring of transactions and have a clear veto right. Furthermore, the originators should not be primarily incentivised by the conclusion of individual transactions, but should participate in the long-term success of the company.

2. Strategy

For the success and performance of the fund it is crucial how restrictively the manager controls the capacity, i.e. that he adjusts the managed assets to the given investment opportunities and not the other way round. Capacity management not only has a significant impact on the level of return, but also on the risk profile of the strategy.

3. Risk Management & Operations

Risk management in trade financing is not limited to the selection of suitable counterparties and the consistent structuring of financing (underwriting), but also includes close monitoring of ongoing transactions (operations). The settlement area is particularly important for trade finaning, as this is where the greatest risks to the strategy exist.

4. Structure

It is also important to understand what types of trade finance the manager is entering into. Basically, there are two types of financing. The first type of financing requires the full repayment of the loan granted to the manager before he can lend the capital again. In the second case, the manager only provides credit facilities where the funds do not have to flow back after each transaction, but are immediately available to the trader. It is considerably more difficult to assess the overall risks here, as there is only limited transparency due to the lower account turnover.

Quantitative analysis

In trade financing, you should always look at the evolution of returns relative to assets under management and keep an eye on them over time to see when the manager is reaching or exceeding capacity. The number of individual positions and the size of the loans are also important indicators for the selection of managers. As the fund volume rises, both will typically rise parallel, but also here the figures have to be observed together with the performance, as conclusions can be drawn about the capacity or the achievement of the capacity limit. By looking at the inflows and outflows to and from the manager’s cash account, adjusted for investor inflows and outflows, and comparing them to the fund volume, one can draw conclusions about the average maturity of the underlying transactions.

Conclusion

Liquid Alternative Credit is a very interesting asset class with an attractive risk-return profile. A portfolio that is diversified across the various strategies is characterised by a high cash yield, low correlation to the credit markets, low volatility and very good risk hedging. Due to its low duration, the asset class is largely independent of interest rate risks, and it is possible to diversify investments globally in various market segments. Nevertheless, the asset class is often underrepresented in German portfolios. The reasons for this are usually the particular complexity and the relatively high effort involved in manager selection as well as the typically low investment capacities of only USD 50 million per manager. However, with appropriate resources, a well-diversified allocation to multiple managers can be created that also allows for larger investments and can be a valuable addition to most portfolios

Toni Quittschalle

Manager Selection

Prime Capital AG

Frankfurt am Main

Tilo Wendorff

Managing Director, Absolute Return

Prime Capital AG

Frankfurt am Main